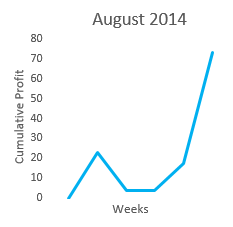

With the State of Origin series done and dusted for 2014 the NRL finally returned to some normalcy over the month of August and along with it returned my betting profitability. However, results were still a bit volatile since with some teams falling out of finals contention it remained difficult to anticipate whether these teams would fire up with nothing to play for but pride.

With the State of Origin series done and dusted for 2014 the NRL finally returned to some normalcy over the month of August and along with it returned my betting profitability. However, results were still a bit volatile since with some teams falling out of finals contention it remained difficult to anticipate whether these teams would fire up with nothing to play for but pride.

There were 5 rounds of football played, though I did give myself a week off in Week 23 as I needed to freshen up. The week off did wonders for me as I recorded my best week of the year during Week 25, though admittedly I got lucky with a few nicely priced wagers it was probably luck that was due to come my way after some horrible fortune that struck me during the coldest months.

The betting results for August 2014 were a little bit mixed, but overall they are positive as my betting performance returned to good form. Below is the weekly summary in table form :-

| Week | Number of Bets | Strike Rate | Net Profit (in units) |

| NRL Week 21 | 35 | 31.42% | +22.93 |

| NRL Week 22 | 41 | 19.51% | -19.04 |

| NRL Week 23 | 0 | 0.00% | +0.00 |

| NRL Week 24 | 38 | 28.94% | +13.37 |

| NRL Week 25 | 39 | 38.46% | +55.73 |

| TOTAL | 153 | 29.41% | +72.99 |

The highlight here is clearly the result in Week 25 which was an abnormally good week primarily due to landing a number of nicely priced Tryscorer bets, but I’m not complaining. Overall the month of August fell just a couple of units short of completely reversing the losses made in June and July so it has been a satisfying bounce back after the difficult State of Origin period and an important return to form heading into the NRL Finals Series.

Looking more closely at the breakdown of betting across market types we have :-

| Market Type | Number of Bets | Strike Rate | Net Profit (in units) |

| Match Handicap | 20 | 35.00% | +10.14 |

| 40 Min Handicap | 17 | 52.94% | +1.40 |

| Margin Bracket | 9 | 22.22% | +13.00 |

| Match/Team Points | 21 | 47.62% | +8.57 |

| Points Bracket | 3 | 0.00% | -2.00 |

| Halftime / Fulltime | 10 | 10.00% | -7.30 |

| First Scoring Play | 17 | 11.76% | -11.60 |

| Tryscorers | 54 | 24.07% | +59.57 |

| Other | 2 | 50.00% | +1.20 |

| TOTAL | 153 | 29.41% | +72.99 |

Even though the Tryscorers category is clearly where the bulk of the profit is coming from this month, it is encouraging to see many of the other categories also showing a modest profit. The Margin Bracket category is showing a profit for the first time since early in the season after landing a couple of Halftime Draw bets at 12.00 each and the Match/Team Points category is also in profit for the first time in months primarily due to a change in strategy where I avoided more of the short odds (sub 2.0) and cherry picked for value markets at odds of 2.20 to 3.50 so that when I am right about points I am getting better payouts. I also had better success with betting on Team Points (even for just a 40 minute period) than Total Match Points.

On the flip side, I tried a new strategy with the 1st Scoring Play markets to try and take the underdog for a Try as 1st Score at odds of 2.50+ but this mostly backfired. I landed a couple so I am not totally convinced it’s a failed strategy as it still performed better than backing penalty goals which is a strategy that worked early in the season but I think that has died off as the season progresses and teams get more confident with their attacking options. I’ll need to do some deeper analysis here.

The Halftime/Fulltime category was also a disappointing result for the second month in a row. I’ll need to have a closer look at my strategy here too as late season fatigue could be affecting teams ability to mount comebacks after half time. It also could be related to the fact that some teams are dropping out of contention this time of year and not showing the sort of early game intensity you can generally rely on earlier in the season.

For any more detailed analysis of my betting performance in August, feel free to check out my Facebook Page where all of my bets have been posted prior to kickoff. Or, if you would like to ask any specific questions about my August betting, please write to me at phantomlongshot@flameburst.com